- Reviewed by Rowena Ferrall, Principal Lawyer at Ferrall & Co Lawyers in Caloundra, Queensland.

- Last-reviewed date: January 2026

- Sources: “Cites Federal Circuit and Family Court of Australia, Queensland Government resources, and local Sunshine Coast legal services.”

Do the cost of divorce in Australia worry you? Not knowing what expenses to expect can be stressful. We believe it would be a good thing to walk through the typical costs involved. This isn’t to make you worry about the process. Quite the opposite. Family law can seem expensive, but there are ways to mitigate how much you spend. We’ll go through all of this to empower you to look forward to a new beginning.

Estimate Your Divorce Costs in Minutes

Use our Divorce Cost Estimator to get a clearer view of your potential legal and living expenses.

The divorce fee rates in Australia are indexed to inflation and increase yearly.

How much does a divorce cost in Australia?

How much does it cost to get a divorce? All divorces go through the Federal Circuit and Family Court of Australia. That includes couples married overseas who meet Australian residency requirements. The cost will include a court filing fee. You can pay at lodgement with a pre-paid debit card.

This information is general only, and fees may change. A family lawyer can provide advice specific to your circumstances. The rate for filing a divorce increased by the following:

1 July 2024: $1100

1 July 2025: $1125

Decree of Nullity

If your marriage is found to be invalid, it may be annulled. The rate of filing a decree as to Nullity increased by the following:

1 July 2024: $1560

1 July 2025: $1595

Estimate Your Divorce Costs in Minutes

Use our Divorce Cost Estimator to get a clearer view of your potential legal and living expenses.

Divorce Cost Estimator

Estimate your divorce costs and get a clearer picture of your potential legal and living expenses.

| Category | Description | Estimated Cost (AUD) | Actual Cost (Editable) | Paid? (Yes/No) |

|---|---|---|---|---|

| Court Filing Fee | Standard fee for filing divorce application | $1,060 | ||

| Lawyer Consultation Fee | Initial meeting with a family lawyer | $250–$500+ | ||

| Application Preparation Fee | If a lawyer prepares your divorce documents | $300–$1,000+ | ||

| Consent Orders (if needed) | Cost to formalise property/parenting agreement | $3,000–$5,000+ | ||

| Mediation Costs | Fees for attending private or court-ordered mediation | $500–$2,000+ | ||

| Legal Representation (Court) | If your case goes to court | $5,000–$20,000+ | ||

| Other Fees (e.g., affidavits, subpoenas) | Additional legal paperwork or services | Varies | ||

| Translation/Interpreter Fees | If English isn't your first language | Varies | ||

| Travel/Childcare/Time Off Work | Related to court/mediation attendance | Varies | ||

| Total | $21,435 | $0 | ||

Total Estimated

Amount Paid

Remaining

What does a replacement marriage certificate cost?

You need to prove you’re legally married before you can get a divorce. That’s what your marriage certificate is for. Have you misplaced your certificate? What will it cost to get another one?

Official certificate of marriage (standard postage fees included): $56.20

Urgent application: $33.30

What are the costs associated with parenting and property arrangements?

Ending a marriage is one thing. But what about parenting and property arrangements? There are various ways of handling those matters. It’ll come as no surprise that they also have costs. Here are expenses you may expect.

Consent orders

Consent orders can be used to finalise financial, parenting, and living arrangements. Here’s how consent order fees have changed:

1 July 2024: $200

1 July 2025: $205

What are court order filing fees?

Unless you’re eligible for a concession, you’ll need to pay a fee to sort out your arrangements through the Court. Orders can be temporary or final. The price you end up paying will depend on what you’re applying for.

Family law matters can be time-critical. That’s what interim orders are for. If you’re in a situation where a child’s welfare is at risk or other urgent matter, you can seek an interim order that will be in force until the final orders are determined.

The divorce costs of legal applications include the following:

Initiating Application (parenting OR financial, final orders only): $435

Initiating Application (parenting OR financial, interim and final orders): $585

Initiating application (parenting AND financial, final orders only): $710

Initiating Application (parenting AND financial, interim AND final orders): $860

Interim order application/application in a case (parenting AND/OR financial): $150

Court proceedings

Do you want to maximise your legal expenses? Litigation is the ticket. No one would accuse litigation of being cheap. This is one of the many reasons why it’s usually recommended to settle disputes through mediation. A big part of why litigation is so expensive is how long it takes. You could be caught up in hearings for as much as two years, depending on your case’s complexity.

Experienced solicitors may charge in the range of $3,000 to $6,000 per day for representation. Legal costs can reach $100,000 or more. Costs vary based on individual circumstances. This information is general in nature only.

Fee exemption

The Court doesn’t want people suffering because the cost of accessing the legal system is too much for them. People need to have a way settle family law matters after they separate. That would be a little difficult if the court fees prevent parties from settling critical issues. Mitigating those concerns makes the legal system fairer and more accessible.

Pro tip: Determine your eligibility for a fee waiver or reduction. This may involve compiling financial resources to show financial hardship.

In certain circumstances, you may be eligible for a reduced rate or waiver when making an application. Government concession card holders may get an exemption. You may be exempt from payment if you are:

The primary cardholder (not a dependant of a primary cardholder) of a health care card, pensioner concession card, or Commonwealth seniors health card.

Granted legal aid for the proceedings the fee is for.

Receiving youth allowance, Austudy or ABSTUDY payments.

Under the age of 18.

An inmate of a prison or otherwise legally detained in a public institution.

If you don’t satisfy the above criteria, you may still be eligible for a reduction if you demonstrate financial hardship. So, how do you prove that? There are three tests. These tests may consider care arrangements impacting your financial situation.

Financial hardship tests

Financial difficulties shouldn’t prevent anyone from being able to access the family law system. Even if you don’t meet the above criteria, the Court may still give you a way to manage the filing costs. You just need to demonstrate financial hardship. Three tests determine if you’re experiencing financial hardship:

The income test.

The assets test.

The daily living expenses and liabilities test.

Income test

The income test is applied to your gross income. The test considers income you may receive from numerous sources, including:

Employment income: wages, salary, and self-employment income.

Employer-provided fringe benefits.

Rental income.

Paid Parental Leave.

Lump sum payments such as redundancy, leave or termination payments.

Foreign income.

Income from financial investments such as bank accounts, managed investments and shares.

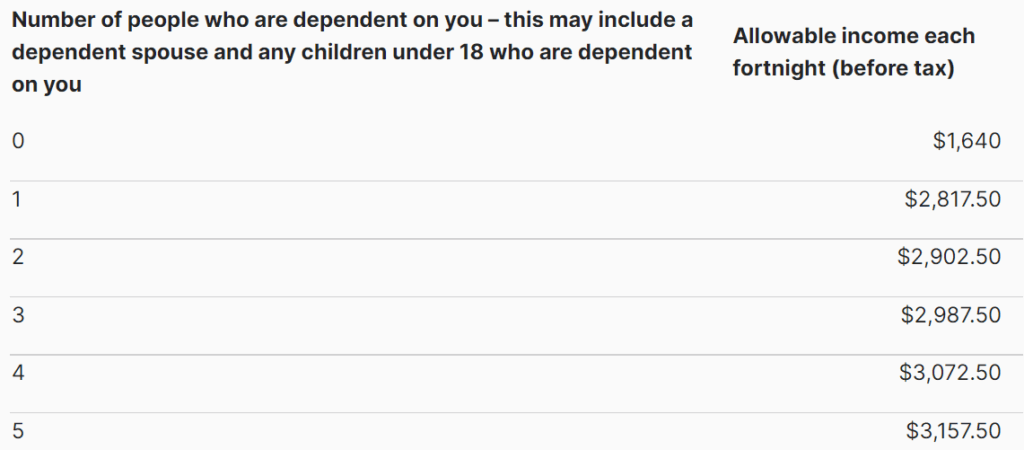

The party’s number of dependants affects the income allowable under this test, taking into account their overall financial situation. The table below shows how the number of dependants affects the income permitted under this test, including where family dispute resolution has been attempted or considered.

Assets test

The assets test considers your cash and convertible shares or bonds. To satisfy this test, the value of these liquid assets must not exceed five times the fee in question. For example, if an individual is applying for a consent order, the value of their liquid assets cannot exceed $1025 (5 x $205).

Daily living expenses and liabilities test

You may still be required to pay the full rate if your surplus fortnightly income exceeds a certain level. Your surplus income is considered your income after covering all reasonable daily living expenses. These expenses can include things like Austudy payments, process server expenses, and the following:

Food.

Rent or home mortgage payments.

Credit card debts.

Other loan or lease repayments.

Electricity.

Phone(s).

The costs of running a motor car.

The allowable surplus income under this test with respect to relevant expenses is the following:

Filing fees (maximum allowable surplus income)

Application for consent orders: $205 ($100).

Application for declaration of validity: $1,595 ($795).

Initiating application (children and financial): $710 ($355).

Initiating application: $435 ($215).

Response to initiating application: $435 ($215).

Notice of appeal: $1,705 ($850).

Daily divorce hearing fee (for each hearing day, excluding the first hearing day): $790 ($395).

Setting down for hearing fee (defended matters): $790 ($395).

Conciliation conference: $490 ($245).

Subpoena fee: $65 ($30).

Interim application: $150 ($75).

Reduced fees

As of 1 July 2025, the reduced divorce and annulment fees are:

Application for divorce: $375

Application for decree as to Nullity: $530

Additional cost reduction methods

There are other resources you could use to save money. Let’s look at some options.

Dispute resolution

We’ve already spoken about how court proceedings do a great job at draining your money. What’s the alternative? It’s to talk out your differences with your former partner. It’s easy to say that. People don’t usually get a divorce because they get along so well. But mediation isn’t informal. A professional mediator will help you structure the discussion in a constructive way so you can get results.

Mediation fees will differ between providers. However, you could expect to pay approximately:

$350-$500 per hour.

$2000-$4000 per full day.

Legal Aid

Every state and territory has its own Legal Aid Commission. Legal Aid offers online legal information and access to free or low-cost representation from preferred suppliers. Representation is subject to means testing and the merits of the case. Legal Aid will look at the chances of the case being successful.

Pro bono

Some firms take on a select number of pro bono cases every year. These spots tend to be very limited, and you may need to wait a long time to get a chance to have your case considered.

What are your legal fees?

A family lawyer generally offers a rate for many family issues. So, what are the divorce lawyer rates involved with legal representation?

Here are some divorce lawyers Caloundra cost approximations to give you an idea of what you could expect to pay.

Joint application divorce fees application: $1000

Sole application divorce fees application: $1500

Parenting/property consent: $1500-$2000

Combined parenting/property consent: $3000

Preparing a financial agreement (with legal advice and certificate): $3000-$8000

Providing independent legal advice and certificate: $1000

Financial disclosure and property settlement negotiation: $3000

Family dispute resolution support: $1000

Initiating application or response to application (parenting and/or property: $5500-$6000

In some cases, fees can be higher if the matter proceeds to court rather than being resolved through negotiation or mediation.

Pro tip: Speak with your lawyer. A reputable firm such as Ferrall and Co. will work with you to understand your financial circumstances and develop a suitable legal strategy.

An effective lawyer won’t just apply some pre-conceived template. They can form a unique strategy for you. Set up an initial consultation if they offer one. Talking with you lets them understand your needs.

Work with your lawyer to assess your legal priorities to maximise your lawyer’s assistance. This should include prioritising cost-effective dispute resolution opportunities where possible. You can then determine an appropriate fee structure.

Speak with your lawyer about how flexible they could be with the divorce cost payments. For example, a payment plan with regular instalments could be useful. That doesn’t mean you’re locked into that plan. Make sure your lawyer’s making regular reviews. Things can change. If something’s going to affect your costs, you’ll want to know about it. Adjustments can make your strategy better.

How lawyers charge for divorce proceedings

Firms make their own decisions about how their services will be priced. But there are some typical models that many follow. Fixed fees could be offered for some predictable workloads. Hourly rates can be used for other situations.

Fixed rates

Fixed rates can provide clients with a sense of security, knowing how much a divorce process will cost upfront. This will help with budgeting for the cost of divorce in Australia. This can also add to the trust between the client and the lawyer. Keep in mind that the price of fixed-rate services generally makes certain assumptions, such as:

You’ve already come to an agreement with your ex-partner.

Financial disclosure has been completed.

Your property pool doesn’t include assets like investment properties.

Hourly rate

An hourly rate allows a family lawyer to adjust their service as needed. It also provides clients with a more detailed breakdown of the work completed by their lawyer. This can be especially important in high-conflict situations where one’s ex-partner may not be cooperative, and detailed legal support is necessary.

The rate the lawyer charges is generally based on their experience:

A junior lawyer may charge $200-$400 per hour.

A more senior lawyer may charge $500-$800 per hour.

Take Control of Your Finances During Divorce

Download our free Divorce Budget Template to plan clearly, reduce stress, and make informed decisions.

Hidden Divorce Costs Most People Forget

Process server fees (sole applicants): $100-$150

Marriage certificate translation (NAATI): $50-$80

Superannuation splitting fees: $300-$500

Property valuation costs: $300-$600

Business valuation costs: $2,000-$10,000+

Additional mediation if agreement breaks down

How are divorce costs split?

Legal expenses may be determined by any agreements the parties had. Court fees and other legal costs may be handled in different ways. How should these expenses be divided between divorcing spouses?

If a party is pursuing a sole application, they will typically be expected to cover the other costs of divorce. A joint application form may allow both individuals to agree on sharing the divorce filing fees.

Legal expenses are usually covered by the other party receiving the service. However, other services bring both individuals together under the same roof. Individuals may be required to undergo counselling or a mediation process to satisfy certain requirements. The fee for these sessions can be split between the former partners by agreement.

How are divorce settlements taxed?

Transfer of property

Divorcing couples may qualify for a capital gains tax (CGT) rollover. Any property transferred between the former spouses is not subject to capital gains tax.

However, this only applies to property transferred through a court order or binding financial agreement. You can’t make an informal agreement with your ex-partner and expect the tax office to still let you benefit from the rollover.

Pro tip: Formal property settlements may avoid capital gains tax on asset transfers.

Transfer of real estate

In certain circumstances, transferring the family home between spouses can be exempt from CGT through the main residence exemption. This exemption is predicated on the following conditions:

The home was the primary residence for you, your former partner and any dependants for the entire period you owned it.

You didn’t use the residence to generate income. That is, you didn’t run a business from home or purchase the home for the purpose of flipping it for a profit.

The house is on 2 hectares or less.

Spousal maintenance

Spousal maintenance and child support can be very important. Fortunately, neither is part of the receiving party’s taxable income. Of course, that also means they aren’t tax-deductible.

Pro tip: Consider options for child support and spousal maintenance. This financial support can be crucial is you have financial concerns.

Superannuation

There isn’t any tax payable on superannuation when it’s split for a property settlement. The total cost and tax implications may vary depending on the party’s circumstances, especially once the superannuation reaches the retirement phase.

Download our FREE Divorce Checklist for more information on what to do next.

Paying for legal representation

Personal savings

Some clients choose to temporarily reduce discretionary spending, such as at retail outlets, to manage their legal costs more effectively. If you have sufficient savings, you can use that to cover legal expenses, provided you are not sacrificing other essentials. You may be able to mitigate the financial impact on your savings by organising a manageable payment plan with your lawyer. For example, some lawyers will defer payment until after the close of the case.

Family loan

You might consider approaching a family member for financial assistance. This is a risky option because it can create complications in your relationship. If you think it’s a good option, here are some tips:

Put the agreement in writing. It’s too easy for the parties to misremember a verbal agreement.

Communicate with each other. Be open about how repayments are coming along and any difficulties.

Personal loans

Personal loans are a common way for people to fund their legal costs and are fairly simple to apply for. They can be secured or unsecured. Unsecured legal fee loans don’t require the borrower to provide security for the loan, although they typically have a higher interest rate to cover the risk taken on by the lender.

Borrowers pay back these loans over a time limit that can extend for months or years, depending on the loan size. Lenders assess borrowers by their credit score and income stability.

JustFund

JustFund is a new fintech company. They’re an interesting alternative financing option to traditional lenders. As a credit provider, they focus entirely on supporting clients. Other lenders will provide a loan and leave the borrower to handle repayments with interest accruing over the life of the loan.

As opposed to a loan provider, JustFund offers a line of credit that can be used to cover legal expenses for property and parenting matters. Borrowers don’t repay anything until the completion of their divorce settlement. The repayment is taken from your property entitlement and you only repay the funding you used. You’re not saddled with a loan obligation that lasts months.

JustFund’s team is staffed by experienced family lawyers who are intimately familiar with legal financing needs. They ensure your funding is suited to the specifics of your case so your finances are managed as efficiently as possible. Poor credit or financial insecurity is no barrier to getting approved. Applicants may still be eligible for support even if they’ve been denied funding elsewhere. JustFund wants to help you secure a healthy financial future.

Ferrall and Co. are a proud JustFund partner. We’ll work to ensure you can access critical funding when you most need it.

From our clients

Ferrall and Co. is committed to providing high-quality and affordable legal assistance to Caloundra residents. Our clients have spoken loud and clear about the benefits they’ve received.

Rowena and her team were absolutely amazing and went above and beyond for me and my daughter. They sorted out my family matter in a very timely manner and very well priced.

Kayla McGrath

Rowena and her team at Ferrall & Co went above and beyond to help me achieve what no other firm I previously engaged were able to do. Not only that, it was achieved in a timely and cost-effective manner in comparison, with clear and effective guidance throughout.

James Walker

Highly professional, wonderful team that always greet you as if they were just waiting to hear your voice. Rowena is an absolute powerhouse that goes in to battle for you, regardless of the misconduct from OP.

Gemma Parry-Jones

Conclusion

Are you facing a family law case but don’t know the cost of divorce in Australia or the costs involved? Not to fear. Our comprehensive guide is what you need. It outlines the major expenses you can expect during the legal process. If you’re concerned about your budget, there are ways to reduce the money you pay.

This is our updated family law costs guide. We cover court fees and potential legal expenses.